Understanding commercial property insurance in Texas requires identifying if your policy covers full replacement or only depreciated value. This distinction between Replacement Cost Value and Actual Cash Value determines your total financial liability. Texas law also strictly mandates deductible payments that can cost building owners thousands. This guide clarifies these critical policy details. You will learn to calculate true costs and protect your bottom line from expensive claim denials.

Table of Contents

Why Commercial Roof Insurance in Texas is Critical

Texas leads the nation in hail and wind events. Because severe weather is a statistical certainty rather than a possibility, insurers have tightened guidelines to protect their reserves.

Modern commercial policies often feature high percentage deductibles or aggressive depreciation schedules for aging flat roofs (TPO, Modified Bitumen, Built-Up). If you fail to audit your policy details, a single hailstorm could result in a six-figure capital expenditure (CapEx) merely to cover the deductible and depreciation. In Texas, a robust policy and understanding that policy is the primary defense for your Net Operating Income (NOI).

The Texas Factor: Unique Risks for Business Properties

Texas presents the most difficult environment for commercial roof protection for three distinct reasons:

- #1 in Hail Damage: Texas sustains more hail volume and commercial insurance claims than any other state.

- Thermal Shock & Extreme Cycles: We face hurricanes, tornadoes, and extreme UV exposure. The rapid expansion and contraction caused by Texas heat cycles degrade commercial membranes faster here than in other climates.

- Stricter Underwriting: Due to high risk, Texas commercial policies are stringent. They often utilize “percentage deductibles” based on the building’s value, and many now include “Cosmetic Exclusions” for metal roofs, meaning they won’t pay for hail dents unless the metal is actually punctured.

What Standard Commercial Property Insurance Covers

Not all commercial forms are created equal. Below is a breakdown of what a typical “All-Risk” or “Special Form” policy usually covers.

Basic Perils Included

Most standard commercial policies cover damage to the building structure caused by:

- Hail

- Wind / Hurricanes

- Fire

- Falling objects/debris

- Weight of snow or ice

What is Often NOT Covered (The Exclusions)

Commercial owners frequently encounter denials based on:

- Wear and Tear: Insurers do not pay for aging membranes or rusted decks.

- Neglect: If you lack maintenance records proving you cared for the roof, claims may be denied.

- Cosmetic Damage: Especially common with metal roofing, if the roof functions but looks dented, many policies will pay $0.

- Pre-existing Damage: Damage from a storm two years ago that went unreported is excluded.

ACV vs. RCV: The Valuation Clause That Matters Most

This is the single most significant financial variable in your policy. Your payout depends on whether your endorsement specifies Actual Cash Value (ACV) or Replacement Cost Value (RCV).

ACV (Actual Cash Value)

- Definition: Pays the cost to replace the roof minus depreciation.

- The Risk: If your 20-year-old warehouse roof costs $100,000 to replace but has reached the end of its “useful life,” the insurer may depreciate it by 80%. You might receive a check for only $20,000, leaving you to pay $80,000 out of pocket.

- Context: Common in policies for older buildings or to keep premiums low.

RCV (Replacement Cost Value)

- Definition: Pays the full cost to replace the damaged roof with like kind and quality, minus your deductible.

- The Payout: Typically paid in two phases: the ACV initially, and the “recoverable depreciation” released once repairs are completed and invoiced.

- Context: Essential for protecting cash flow, though premiums are higher.

The High Cost of Deductibles: Percentage vs. Flat Rates

In Texas, commercial policies rarely use a flat $1,000 deductible anymore. Instead, they use percentage deductibles based on the Total Insured Value (TIV) of the building.

The Math of Percentage Deductibles

- Flat Deductible: A fixed cost, e.g., $5,000 per occurrence.

- Percentage Deductible: Usually 1%, 2%, or even 5% of the building’s insured limit.

Example: You own a commercial building insured for $2,000,000 with a 2% wind/hail deductible.

$$2,000,000 \times 0.02 = \$40,000$$

You must pay $40,000 out of pocket before the insurance company contributes a dime.

Note: Always check if your policy applies the deductible per building or per location.

The Commercial Claims Process Step-by-Step

Managing a commercial claim is a business transaction. Here is the standard workflow:

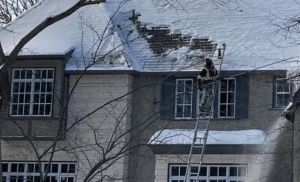

- Damage Assessment: Following a storm, have a professional commercial roofer inspect the membrane, flashings, and HVAC units.

- File the Claim: Contact your broker or carrier immediately.

- Adjuster Inspection: The insurer’s adjuster will inspect the property. Crucial: Have your roofing contractor present to walk the roof with the adjuster. This ensures they agree on the scope of damage immediately.

- Scope & Estimate: The insurer provides a Statement of Loss. Review this carefully against your contractor’s estimate.

- Restoration: Select a licensed, insured commercial roofing contractor to perform the work.

- Recovery: Submit the Certificate of Completion to recover any held-back depreciation (if you have RCV coverage).

Common Mistakes Property Managers Make

Commercial claims are often denied or underpaid due to avoidable errors.

- Waiting too long: Commercial policies have strict “statute of limitations” for reporting loss.

- Ignoring the “Cosmetic Waiver”: Signing a policy that excludes cosmetic damage on metal roofs can devalue your building significantly upon resale.

- Lack of Maintenance Logs: Failure to prove annual inspections can give insurers grounds to argue the damage was “wear and tear,” not storm-related.

- Assuming Business Interruption is Automatic: Check if your policy covers lost rents or downtime during repairs.

Proactive Measures: Preparing Your Roof and Policy

You can mitigate financial risk before the storm hits.

- Annual Commercial Inspections: Document the roof’s condition annually. This establishes a baseline “pre-storm” condition.

- Review Your Dec Page: specifically look for “Wind/Hail Deductible” and “Valuation” (ACV vs RCV).

- Clear Rooftop Debris: HVAC panels, loose equipment, and tree branches become projectiles in high winds.

- Consider Impact Resistant Materials: Upgrading to TPO with a fleece back or higher-grade metal can lower premiums and reduce damage frequency.

Final Thoughts: Protecting Your Asset and Your ROI

Understanding your commercial property insurance is a fiduciary responsibility for Texas business owners. Storms are unpredictable, but your coverage shouldn’t be. Core Commercial Roofing & Coatings advises that you verify your valuation clause (ACV vs. RCV), calculate your potential deductible liability, and maintain rigorous inspection logs.

By proactively managing your policy and your physical assets, you protect your company’s capital and ensure business continuity when disaster strikes.

FAQs

How does a roof insurance claim work in Texas?

The process involves four main steps: damage verification, filing the claim, the adjuster meeting, and the final settlement. Core Commercial Roofing & Coatings advises that you always get a professional inspection before contacting your insurer. If the damage is less than your deductible, filing a claim is a mistake that adds a “zero-payout” record to your property history, potentially raising your future premiums without giving you any benefit.

Can I claim roof damage on insurance?

You can validly claim damage if it stems from a specific “date of loss” event, such as a severe hailstorm or hurricane. However, insurance is not a warranty; it will not cover leaks caused by old age, lack of maintenance, or “wear and tear.” If an adjuster sees that your roof failed simply because it was neglected for years, the claim will likely be denied.

What is covered under a commercial property insurance policy?

Standard policies cover “direct physical loss” to your building caused by major perils like wind, hail, fire, and lightning. Crucially, this often includes interior damage if the storm created an opening in the roof. However, most standard policies exclude flood damage (rising water from the ground) and equipment breakdown unless you purchase specific extra endorsements.

What are the rules for insurance claims in Texas?

Texas law protects both the insurer and the owner. First, you must legally pay your full deductible; it is a crime for a contractor to waive or absorb it (House Bill 2102). Second, Texas Insurance Code Chapter 542 requires insurers to act fast: they typically must acknowledge your claim within 15 days and accept or reject it within 15 business days after receiving all required information.

What is the difference between RCV and ACV in commercial roof insurance?

RCV (Replacement Cost Value) pays for a brand-new roof without deducting for age. ACV (Actual Cash Value) only pays what your old roof is worth today. Core Commercial Roofing & Coatings warns that ACV policies can be financially dangerous for older buildings. If your roof is 15 years old, an ACV policy might deduct 75% of the replacement cost, leaving you to pay the majority of the bill out of pocket.

How are commercial roof deductibles calculated in Texas?

Unlike residential policies that use flat fees (like $1,000), commercial deductibles are usually a percentage of the Total Insured Value (TIV). For example, if your warehouse is insured for $5 million and you have a 2% deductible, you are responsible for the first $100,000. This amount must be paid before the insurance company contributes a single dollar.

Does commercial property insurance cover hail dents on metal roofs?

It depends on if your policy has a “Cosmetic Damage Exclusion.” If this exclusion exists, the insurer will not pay for dents unless the metal is punctured or the roof leaks. Core Commercial Roofing & Coatings advises owners to be careful here: even if the roof doesn’t leak, a heavily dented metal roof can lower your property’s resale value by up to 20%, and you won’t have insurance money to fix it.

Do I need a roofing contractor present for an insurance adjuster inspection?

Yes, absolutely. The adjuster represents the insurance company’s interests, not yours. Core Commercial Roofing & Coatings acts as your advocate during this meeting to ensure the “Statement of Loss” is accurate. We point out damage to flashings, HVAC units, and membranes that adjusters might overlook, ensuring your initial settlement offer is fair and comprehensive.

How does depreciation affect commercial roof insurance payouts?

Depreciation is calculated based on the age of your roof versus its expected lifespan. If you have a Replacement Cost policy, this money is only “held back” and is released to you after you prove the repairs are finished. If you have an Actual Cash Value policy, this money is permanently deducted, meaning you never get it back, significantly reducing your total claim check.

Does upgrading commercial roofing materials lower insurance premiums?

Yes, standard Texas policies typically cover hail damage under your dwelling coverage, provided the damage is functional and not merely cosmetic. However, because hail is so frequent in Texas, many policies now include a specific percentage-based deductible for wind and hail that differs from your “all other perils” deductible. To ensure you have a valid case before filing, Core Commercial Roofing & Coatings can perform a professional inspection to differentiate between actual storm damage and normal wear, preventing you from filing a claim that might be denied.